Gold rose to a record high in late 2023 amid geopolitical conflicts and economic uncertainty. Will safe-haven demand and the US interest rate outlook keep gold supported in 2024? What is the gold price prediction for the next 5 years? We look at the gold price forecast for 2024, and beyond from banks and experts.

The gold spot hit an all-time high on December 4, spiking up to $2,141 per ounce before falling to trade below the August 2020 high, Technically, the rise could have been “driven by stop-loss orders”. Fundamentally, on growing expectations for US rate cuts earlier next year.

Gold delivered a moderate performance in 2023. Gold spot (XAU/USD) and gold bullion ETF SPDR Gold Shares (GLD) added more than 17% last year (considering the 2023 high). A weaker US dollar and lower treasury yields, along with increased geopolitical uncertainty, are prompting the higher prices – and analysts don’t expect it to stop there.

Gold prices are forecasted to hit fresh highs and to remain above $2,000 levels in 2024, analysts said, citing geopolitical uncertainty, a likely weaker U.S. dollar, and possible interest rate cuts. Is now a good time to invest in gold?

Gold Forecast & Price Prediction – Key Notes

- Gold forecast in the coming days: Gold prices may oscillate at $2,080 highs or even consolidate with a retracement towards $2,000+ in the remaining of 2023. Many significant technical and fundamental drivers (see the below sections) are accumulated to prepare a breakout.

- Gold price prediction 2024: Analysts expect prices to remain above the $2,000 level next year as the global rush for gold continues. The gold price prediction points towards new record highs and moderate gains.

- Gold rate forecast for the next 5 years: While most analysts predict a moderate gold price increase in 2025, the most optimistic gold rate predictions for the next 5 years are pointing towards $3000.

With EVPMarket you can trade CFDs on gold spot (XAU/USD) and gold bullion ETF (GLD) if you want to speculate on price movements or invest in gold mining stocks or gold mining ETFs.

Gold Forecast 2024 – The Early Days of a Bull Market?

Since gold pays no interest, its price usually rises in conjunction with a decline in interest rates. Powell did not, however, hint at upcoming rate reductions in his remarks. Instead, he noted that the United States has not yet fully felt the consequences of the 5.25% rate hikes of the previous two years in his speech that set off the gold market record highs surge: “Having come so far so quickly, the FOMC is moving forward carefully, as the risks of under- and over-tightening are becoming more balanced.”

The governor also reiterated during the speech that the fight against inflation may not be over: “We are prepared to tighten policy further if it becomes appropriate to do so”. However, analysts point that Powell used the word ‘balanced,’ and the message he’s sending is the Fed is not going to change its rhetoric, but things are going the way they want them to go and they’re not going to raise rates again.

As a result, the markets think they’re done, they’re finished. Traders have advanced expectations for a rate cut from an 80% chance in May to a one-in-two chance in March, according to CME’s FedWatch tool, pushing to upside revisions of the institutional gold price predictions for 2024 and the next 5 years.

Where analysts say it’s going next

| TD Securities is forecasting gold prices to break into new highs in the first half of 2024 as we approach the Fed pivot and (with) the economy likely to slow. | J.P. Morgan highlighted in its 2024 commodities outlook that the only structural bullish call they held across commodities was on gold and silver. |

| Bloomberg Intelligence senior macro strategist Mike McGlone told Yahoo Finance that we might be in the early days of a bull market breaking out to new highs. | According to a survey by the WCG, 24% of all central banks are planning to build up their gold reserves in 2024, on concerns about the USD as a reserve asset. |

However, not all analysts have a bullish gold forecast for 2024.

US Bank Asset Management Group explained that lower interest rates, due to investor hopes for Fed rate cuts in 2024, and a weaker US dollar provided some support over the last eight weeks. Looking forward, a key question for this bullish gold forecast is whether these trends can be sustained. A still-growing US economy and few signs the Fed is close to considering interest rate cuts are likely to temper near-term enthusiasm for gold.

Is it time to invest in Gold?

The gold’s rally from here depends on the Fed’s behavior and the progression of the geopolitical crisis. If the Fed stays put from here, it would be good news for gold investing. Gold investors should closely watch the economic and market events before making any decision.

If this is true, and interest rates may begin falling in the new year, there’s still time to get in on a gold rush. Experts at CBSNews.com warned not to wait until its price climbs higher. Although the price jumped with investor optimism at the end of 2023, the precious metal still has room for growth according to the latest gold price predictions for 2024 (see below).

To sum up: experts can make educated gold forecasts and price predictions, but as with any investment, there’s no 100% guarantee.

How to Invest in Gold in 2024

With EVPMarket, you can invest in gold in many ways:

| Trading GOLD Spot Spot gold involves the immediate purchase or sale of the precious metal, with the exchange occurring at the precise moment the trade is settled, or ‘on the spot’ price. When engaging in spot gold trading, investors open buy or sell positions at the current market rate, commonly referred to as the spot price. | Trading or Buying Gold ETFs Exchange-traded funds (ETFs) can help investors track the performance of shares in a collection of publicly traded gold mining, refining, and production companies. Engaging in ETF trading extends investors’ exposure and hence helps to diversify their portfolios. | Trading or Buying Gold Stocks Gold mining companies and gold mining funds are another way to invest in gold. This will enable investors to diversify their portfolio within the gold industry, either trading (going long or short) or buying shares in companies involved in mining and production of gold. |

Fundamental Gold Forecast 2024 – Factors that could support fresh highs

Despite the US interest rate reaching its highest level in more than 22 years, gold prices have remained strong throughout 2023, even rising to an all-time high of US$2,135 per ounce this week. The outstanding performance may be the result of high demand from central banks and safe-haven flows stemming from Middle East geopolitical tensions, which counteracted the negative effects of the increase in Treasury yields and the strength of the US dollar.

Analysts forecast gold prices to hit fresh highs in 2024, supported by a series of factors.

The environment for gold may remain supportive into 2024

According to analysts, Fed policy will continue to be crucial to the future of gold prices in the coming months. The macroenvironment surrounding the yellow metal should improve if the Fed continues to sound less hawkish and the story around the rate outlook has shifted from this year. Markets now expect 125 basis points of rate cuts through 2024, following the Fed’s most aggressive rate-hiking campaign in 40 years, with the solid view that the cycle of rate hikes has already peaked.

According to the most recent US statistics, markets are now pricing in a 50% possibility of a rate cut in March and a full price cut in May, indicating that both inflation and the labour market are cooling. Growing economic uncertainties will continue to be a major topic in 2024, and any new forecasts of a recession could be favourable to safe-haven gold because of its track record of outperforming other asset classes during six of the last eight recessions.

ING economists forecast the starting point for Fed rate cuts to be in May and are forecasting 150bp of rate cuts next year in total, with a further 100bp in early 2025. This should support the bullish gold forecast and price predictions for 2024 and 2025.

Gold ETFs see ongoing outflows

Although spot prices were resilient, the overall amount of assets in ETFs backed by bullion has decreased this year. October saw a slowdown in the global withdrawals from gold-related exchange-traded funds (ETFs) compared to September. Global outflows in 2013 have amounted to $13 billion, or a 225-tonne decline in equities. Based on data from the World Gold Council (WGC), most of these outflows originated from European funds, with North America being the second main source.

If additional rate-cut talks were to give momentum to the yellow metal, the still-tame thirst for gold might allow for some catch-up buying and lend some support to prices.

Money managers’ net-long positioning in gold has climbed to its highest level since May 2023 (144,410 lots as of November 28, 2023), according to statistics from the Commodity Futures Trading Commission (CFTC). However, it has remained a considerable distance from its peak positions in 2016 and 2019 (~280,000 lots).

Central bank demand hits year-to-date record

According to data from the World Gold Council, as of 3Q 2023, the net 800 trillion tonnes of purchases by central banks represent a 14% YoY increase. During the third quarter of the year, central banks bought 337 tonnes of gold, mostly from China (+78 tonnes), Poland (+57 tonnes), Turkey (+39 tonnes), and India (+9 tonnes).

Global central banks demand in 2022 (1,136 tonnes of gold, compared to 450 tonnes bought in 2021) reached the highest level since 1950, mostly driven by a flight towards safer assets amid soaring inflation. 2023 should near or exceed 2022 purchases, according to the latest gold demand forecasts.

This continued central bank buying amid stronger investment demand supports the positive gold price predictions for 2024 and next 5 years.

Safe-haven demand supports gold

The start of the conflict between Israel and Hamas in October also resulted in some safe-haven flows for the yellow metal, which allowed prices to recover its crucial psychological level of US$2,000. Gold tends to perform well during periods of economic and geopolitical uncertainty due to its status as a reliable store of value: “In the event of a more widespread conflict in the Middle East, gold prices are likely to increase from already high levels as investors shift to safe-haven assets,” according to World Bank.

Gold has held up well despite the easing of worries about a wider Middle East conflict. The price of gold reached a new record high in early December, and it was helped by a weaker US currency and US Treasury yields on the US interest rate outlook.

Analysts anticipate that if the global gold rush lasts, prices will stay above $2,000 according to the institutional gold price predictions for 2024 released in December after the new record highs.

A potential break above the ranging pattern

As the monthly chart shows, since June 2020, the price of gold has been moving in a broad consolidation pattern. A recent effort to break over the upper resistance area eventually failed to materialize, as gold price decreased in the coming days following the spike up to record highs. This implies that the bears are still committed to holding the crucial resistance level at US$2,074, but given the overall upward tilt in the market, any additional retest of this level will be closely monitored into 2024.

The MACD has also recently defended its zero-line, and for the time being the relative strength index (RSI) is still hovering above the crucial 50 level, indicating that bullish momentum is in place.

This is the third test of the key resistance level, and a breakout seems more likely from a technical perspective. While the latest gold forecasts are considering a breakout, a confirmation may result in upside revisions of the gold price predictions for 2024, 2025, and even for the next 5 years.

Technical Gold Forecast 2024 – Needs to overcome $2,080 for the outlook to change

Gold prices decreased in the coming days following the explosive move higher on December 4. The weekly timeframe now looks intriguing with a massive shooting star candlestick as things stand. On the downside, the psychological US$2,000 level will serve as immediate support to hold, followed by the US$1,950, where its 200-day moving average may stand.

However, despite the gold price decrease in the coming days following the spike up, the yellow metal maintains a constructive bias, for which the path of least resistance remains to the upside. If prices resume their advance, the first barrier to watch appears at $2,050, followed by $2,070/$2,075. On further strength, attention shifts to $2,150.

Daily Chart: Will the Gold price decrease in the coming days?

The daily chart shows upside momentum, with a minor countertrend following the swing high. The intermediate uptrend is in place and signals a more likely gold price increase in the coming days and a potential breakout above the 2080 key resistance level.

If the bounce from the key support level will fade, signals a more likely gold price decrease in the coming days and even weeks, as it should continue the sideways trend seen in the last 2-3 years.

To sum up this technical gold analysis, it would raise the odds that the spectacular spike up to record highs signals this multi-year consolidation could turn into a new bull market – a point highlighted in our recent gold forecast & price prediction updates.

How do analysts see the price of Gold moving in the coming months? Below, we look at some of the latest gold price predictions and gold price forecasts for 2024, and beyond.

Gold price predictions for 2024 from experts

Many sources and experts provide gold forecasts and gold price predictions for 2024 based on different models, methods, and assumptions. Despite the average performance in 2024, many investment banks continue to maintain a bullish gold rate forecast for 2024 and the next 5 years. However, the central banks continue to bolster their gold reserves, highlighting the enduring appeal of the precious metal. In the following sections, we will discuss the gold forecasts and price predictions from some of the most reputable and influential sources and experts:

- The World Bank predicts an average gold price of $1,950 per ounce in 2024.

- The International Monetary Fund (IMF) forecast an average gold price of $1,775 per ounce in 2024.

- Goldman Sachs predicts an average gold price of $2,133 per ounce in 2024.

- JPMorgan Chase & Co. predicts the gold price to reach $2,175 per ounce in 2024.

- ABN AMRO has a gold prediction of an average price of $2,000 per ounce in 2024.

- City Group edged its 2024 forecast for average gold prices up to $2,040.

- UBS upgrades its 2024 Gold price forecast to $2,200 from $1,950.

- Commerzbank forecast Gold should succeed in overcoming its all-time high of $2,075 in 2024.

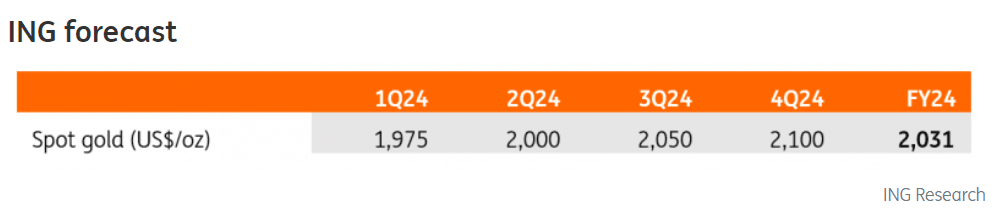

- ING forecast higher gold prices in 2024.

- TD Securities forecast gold prices to average $2,100 in the first half of 2024.

- UOB forecast gold to reach new record highs in 2024.

The World Bank’s Gold Prediction 2024

The World Bank, one of the key players among central banks and a global financial institution offering loans and grants to developing nations for various projects, recently forecasted an average gold price of $1,950 per ounce in 2024, an increase from $1,700 per ounce in 2023. This updated 2024 gold price forecast is built on assumptions that the conflict in the Middle East is set to lead to heightened global uncertainty, with substantial implications to gold prices if the conflict escalates. “Although the initial impact has so far been moderate, its escalation would exacerbate such uncertainty, which would lead to reduced risk appetite as well as lower consumer and investor confidence. These developments could lead to sharply higher gold prices”.

The World Bank’s gold price prediction 2025 states that “Prices are forecast to remain elevated but decline gradually to average around $1,830 an ounce in 2025”.

The IMF’s Gold Forecast 2024

The IMF, an international organization fostering global financial stability, economic cooperation, and sustainable growth, forecasts an average gold price of $1,775 per ounce in 2024, a slight decrease from $1,800 per ounce in 2023. This 2024 gold rate prediction is based on projections of global economic activity, inflation expectations, and financial market conditions.

We are still waiting for an updated gold price prediction for 2024 from the IMF.

Goldman Sachs’s Gold Prediction 2024

Goldman Sachs, a leading global investment banking, securities, and investment management firm, has a positive outlook for the yellow metal in 2024, and forecasts an average gold price of $2,133 per ounce. The firm’s analysts believe that gold will trade higher than the market consensus in the near term, primarily due to its status as a safe-haven asset and the “fear” factor. This fear factor is driven by rising uncertainties, including banking and funding stress and the increased market-implied probability of a US recession in 2024. Goldman Sachs also cites the wealth effect, particularly the boom in income and savings in emerging markets like China and India, as a factor supporting gold prices.

JP Morgan’s Gold Rate Prediction 2024

According to JPMorgan Chase & Co., gold will average $2,012 by the middle of 2024 and hit $2,175 per ounce by the fourth quarter of the year. This is up from a price of about $1,915 as of Aug. 9, 2023. The bank expects the FED to completely reverse its policy of tightening interest rates in the very near future and begin cutting rates by Q2 2024, with falling yields being a “significant driver” for gold. Owning gold in a low-rate environment does force you to give up the high income you might earn from other investments in a high-yield environment. Thus, money tends to flow back into gold, as JP Morgan predicts for the upcoming 12-to-18 months.

ABN AMRO’s Gold Price Prediction 2024

ABN AMRO, a Dutch bank providing various banking and financial services to retail, private, and corporate clients, has a gold prediction of an average price of $2,000 per ounce in 2024, a decrease from $2,200 per ounce. This 2024 gold rate prediction is based on its expectations of a stronger US dollar, higher real interest rates, lower inflation pressures, and weaker investor gold demand.

Citigroup’s Gold Rate Prediction 2024

Citigroup edged its 2024 forecast for average gold prices up to $2,040/oz and said it sees an opportunity to “buy the dip” as U.S. inflation data eases. The improved technical picture for the gold market is based on rising expectations for an end to the Federal Reserve’s rate-hiking cycle, causing Treasury yields to decline, thus aiding low- and zero-yielding assets such as gold and silver.

UBS’s Gold Rate Forecast 2024

UBS, a multinational investment bank and financial services company founded and based in Switzerland, revised its Q1 2024 gold price prediction to $2,200. Prior was $1950. UBS cites three key factors: consistent demand from central banks, inherent weakness in the US dollar, and escalating recession fears in the US.

Commerzbank’s Gold Prediction 2024

Commerzbank, the second largest bank in Germany forecasts gold should succeed in overcoming its all-time high in 2024 and trade at 2100 in the second half of the year. Gold price is likely to trend sideways in the short term, as uncertainty about the future path of US monetary policy remains high. Lower US inflation argues for an end to interest rate hikes, but the robust US economic growth so far argues against a quick turnaround in interest rates.

The bullish 2024 gold forecast is based on expectations that the US economy will slide into recession, which should fuel speculation about interest rate cuts.

ING’s Gold Rate Forecast 2024

The Dutch bank believes that the Fed is done hiking rates with cuts starting from spring 2024 as challenges continue to mount. Real household disposable income is slowing, student loan repayments are due to restart, credit availability is drying up and pandemic-era accrued savings have been exhausted by many households. ING forecasts gold prices to move higher again in the first quarter of 2024 to average $1,950/oz as the dollar weakens, safe-haven demand picks up amid global economic uncertainty and central bank buying remains at high levels.

ING’s gold price prediction for 2024 shows an average price of $2,031, with a high in Q4 at $2,100.

TD Securities’ Gold Price Prediction 2024

TD Securities forecast gold prices to average $2,100 an ounce in the second quarter of 2024, with strong central bank purchases acting as a key catalyst in boosting prices.

According to a recent survey by the World Gold Council, 24% of all central banks intend to increase their gold reserves in the next 12 months, as they increasingly grow pessimistic about the U.S. dollar as a reserve asset.

“This means potentially higher demand from the official sector in the years to come,” explains the analysts of TD Securities.

UOB’s Gold Rate Forecast 2024

Global economics and markets research at UOB said that the anticipated retreat in both the USD and interest rates across 2024 are key positive drivers for gold. As a result, they forecast gold prices could reach up to $2,200 an ounce by the end of 2024.

Other Gold price predictions 2024 (AI-Based)

The “higher-for-longer” global monetary policy stance is still having a negative impact on gold prices, which are hovering around their lowest levels since March 2023.

Although there is still potential for the price of the precious metal to decline, agencies and AI-based websites are still optimistic that prices would rise beyond $2,000 per ounce next year and higher through 2025 despite the short-term setback.

| Wallet Investor – Neutral Gold price prediction 2024 Gold price is forecasted to trade slightly above the 2,100 levels in 2024. The forecasting agency is not expecting Gold to reach new highs during 2024, but to consolidate between $2,013 and $2,114 levels. | Coin Price Forecast – Bullish gold price prediction 2024 In the first half of 2024, the gold price forecast is $2,127; in the second half, the price would add $43 and close the year at $2,170. |

| Long Forecast – Bearish gold price prediction 2024 Gold price prediction for the beginning of 2024 points to a high at $2,408. The AI-based website is forecasting gold to trade around $2,200-2,300 during 2024 and close the year at $2,404. This is one of the most bullish gold price forecasts for 2024. | Trading Economics – Neutral to bullish gold rate forecast 2024 Gold is expected to trade at $2,094 USD/t oz. by the end of 2023, according to Trading Economics global macro models and analysts expectations. Looking forward, they forecast gold to trade at $2,163 in 12 months’ time. |

Gold price prediction for the next 5 years

Though it is hard to say for sure for such a long period of time, experts from different resources concur that gold will continue rising. However, they have opposite opinions about the speed of this growth.

What is the gold price prediction for the next 5 years? See below the forecaster’s projections for gold prices in the 5 years approximately.

| Gold Price Prediction for the next 5 years from Long Forecast The Economy Forecast Agency provides a gold price prediction only till the end of 2027. The 2025 Gold price prediction is a trading range between 2,200 and 2,500. The gold prediction for the next 5 years is $2,342. | Gold price forecast for the next 5 years from Wallet Investor Wallet Investor offers a gold price forecast for the next 5 years. The opening Gold price in 2025 is forecasted to be $2,083. The closing price in June 2025 will be $2,289. At the end of December, the closing price will be $2,131. The first half of 2026 is also nice and pleasant for gold investors. The following periods will also demonstrate the uptrend, and the year will close with $2170 with a maximum of $2,200. Moderate growth will continue untill 2028. The gold price prediction for the next 5 years is $2,260. | Gold Price Prediction 2025-2030 from Coin Price Forecast According to the latest long-term forecast, Gold price will hit $2,400 by the end of 2025 and then $2,700 by the end of 2026. Gold will rise to $3,000 within the year of 2027, $3,500 in 2030 and $4,000 in 2033. This is one of the most bullish gold rate forecast for the next 5 and 10 years. |

*It is worth keeping in mind that both analysts and online forecasting sites can and do get their predictions wrong. Keep in mind that past performance and forecasts are not reliable indicators of future returns. When considering gold price predictions for 2024 and beyond, it’s important to keep in mind that high market volatility and the macroeconomic environment make it difficult to produce accurate long-term gold analysis and estimates. As such, analysts and forecasters can get their gold forecast wrong.

What moves the price of gold in the future?

Unlike almost any other asset, gold is typically neither a safety nor a risk asset, though the popular financial media have often called it both over the years (depending on how gold has been performing in recent months). Instead, it’s a currency hedge for which demand rises when there are concerns about inflation diluting the purchasing power of fiat currencies (particularly those most widely held, like the USD and EUR). In other words:

- In times of optimism (aka risk appetite), gold can either appreciate if markets believe growth will lead to inflation, or it can fall if the desire for higher yields overrides inflation concerns and investors move into more classic risk assets which they believe will provide better returns.

- In times of pessimism (aka risk aversion), gold can either rise if markets believe that stalling growth will lead to rising deficits and/or money printing that could cause inflation, or it can also fall on fears of deflation or a market crash that feeds demand for cash. In times of panic, traders seek cash either to cover margin calls or other obligations or to be ready to go bargain hunting.

If pessimism turns to panic, then gold could either:

– rise if markets are more concerned about the USD or EUR losing their purchasing power than about near-term liquidity needs, as was the case at times from 2009 through 2011.

– fall if markets are more concerned about liquidity than the loss of purchasing power, as was the case in late 2011.

When markets are not concerned about fading purchasing power, the major currencies tend to gain against gold. That can happen due to:

- Low inflation expectations, as we saw starting in late 2011. Concerns about the global economy kept inflation fears low, and so gold began a multi-month downtrend.

- Panic periods are when markets fear a financial crisis, and liquidity becomes the top priority. We saw gold sell-off during times of peak anxiety about the US or EU. During these periods, investors tend to sell gold to raise cash.

How has the price of Gold changed over time?

Below is a Gold chart that shows how the price of gold changed over the past ten years. In order to make our predictions and forecasts as accurate as possible, it’s important to look back at such historical data.

One of the biggest drivers of gold is currency values. Because gold is denominated in dollars, USD can have a significant impact on the price of gold. A weaker dollar makes gold relatively less expensive for foreign buyers and may lift prices. On the other hand, a stronger dollar makes gold relatively more expensive for foreign buyers, thus possibly lowering prices.

Gold Price in 2019

The price at the beginning of 2019 was $1,413.75. Though it fell insignificantly in April to $1,353.26, it continued going up till August and became $1,601.35. However, in November, the price lowered to $1,524.80. The reason for this was the falling gold demand in India. Actually, it fell to its lowest level in three years. The World Gold Council (WGC) explained that this was due to domestic prices climbing to a record against a backdrop of falling earnings in rural areas.

Gold Price in 2020

The price was able to recover and rose up to $2,063.56 in August 2020. This peak hasn’t been reached again yet. The coronavirus pandemic and the unprecedented flow of money supply by government stimulus triggered sharp buying in the bullion metal in both domestic and global markets in 2020.

The price didn’t manage to maintain this high and fell to $1,840.38 in November 2020. Pfizer was the main reason. The US-based pharmaceutical corporation announced the COVID-19 vaccine news. They made a surprising announcement regarding the status of their coronavirus vaccine trial.

Gold Price in 2021

The price managed to recover a little bit, but that didn’t save it from another fall in March 2021 – it fell to $1,742.68 as the dollar strengthened after the jump in US private-sector jobs. “Gold looked as if it was topping out,” Ross Norman, Chief Executive Officer at Metals Daily, said. “Some profit-taking exacerbated the decline, and gold will rebuild from here.” He was right – in May 2021, the price became $1,904.76. Little did he know that the price would again go down, reaching $1,771.60 because of problems with the coronavirus in India.

There were no sharp ups or downs during summer. The first month of Fall 2021 ended with a price decline to $1,726.11 per ounce. The next seven weeks showed a strong recovery – up to $1,866.96. This happened due to the investor’s rush into safe-haven assets. A stronger dollar and the Fed policy led to the following sharp decline. However, the situation changed in December when the bulls took the trend.

Gold Price in 2022

Between the end of January 2022 and the 8th of March 2022, gold had a 16% gain, trying to surpass its previous record high of $2075 per ounce set in August 2020 as a result of the conflict in Ukraine that increased geopolitical tensions and market risk aversion.

Midway through March 2022, the Fed announced its first interest rate increase of the year, and gold started to flex lower. The downward trend in gold prices continued through the summer and into Q3 when Fed Chair Jerome Powell quickened the pace of rises. In the midst of a dollar rally and rising Treasury yields, gold plummeted 22% from its March highs to September lows at 1,615/oz.

After reaching a so-called technical “triple bottom” in the months of September, October, and November, gold started to rise by 12% by the end of December.

Overall, gold’s performance in 2022 was inconsistent when compared to that of other important metals. Copper (-14%) and palladium (-4.2%) were outperformed by the yellow metal, but they lagged behind silver (+4.5%) and platinum (+4.6%).

Gold Price in 2023

May 2023 saw gold prices rise to almost record levels, with a peak at $2,067, a level not seen since March 2022. The ongoing talks over the US debt ceiling served as fuel for the most recent spike. The US economy could run out of cash as early as the beginning of June, according to Janet Yellen, the Treasury Secretary.

However, prices have fallen more than 11% from their May highs above $2,000 an ounce as the FED’s hawkish outlook has pushed long-term bond yields to their highest level in 16 years.

After wild swings, gold showed a strong rebound in Q4 2023 and hit an all-time high, amid geopolitical conflicts and economic uncertainty.

Conclusion: Is Gold a good investment for 2024 and beyond?

Drawing from these expert insights, they anticipate a slight uptick in gold prices for 2024. The average cost could hover around $2,100 per ounce by year’s end. However, it’s crucial to note that this remains a forecast. Things can change, and there’s always a level of uncertainty.

For potential gold investors, experts recommend some gold in a well-balanced, conservative portfolio to protect against inflation diluting the purchasing power of fiat currencies and geopolitical factors. But before you invest in gold, do your homework. Understand the risks and costs of buying and selling gold. And keep a close eye on market trends and conditions.