Indices

Indices bundle up a number of company stocks in one financial instrument. Trade CFDs on 15 major Indices from the U.S., Europe, and Asia, gaining exposure to a wide variety of companies in one sector or nation with one trade.

Trading CFDs on Indices

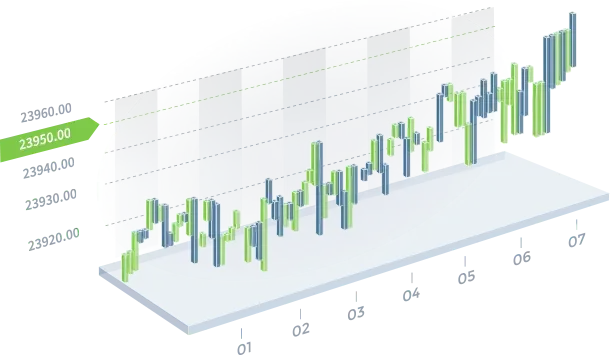

When the markets needed a way to analyze and follow the overall performance of an industry, region, or country indices were created. Indices often reflect political and economic shifts and their effects on the country’s economy, providing exposure to entire market sectors and industries. They reflect the collective value of the top companies trading on a stock exchange.

CFDs on indices offer an accessible way of investing in the price movement of a whole market sector, without actually owning the underlying index constituents. As they’re a collection of top-performing stocks grouped, they provide a broad perspective of the market as a whole.

Since you can’t say how well a country’s economy is performing by looking at a single big company or by following most companies listed on a stock exchange, CFDs on indices offer an efficient method of gathering insights.

Trading Conditions for CFDs on Indices

Trade CFDs on indices from the U.S., Europe, Asia and many more

Leverage up to 1:20

CFDs on over 15 global indices

Minimize trading costs by trading a basket of stocks

How do CFDs on indices work?

They provide an accessible way of trading the performance of a sector of the stock market – this means you’re trading the price of the stocks you like, gathered into a single asset called an index.

You don’t own the index; you just trade the price movement.

Instead of choosing to trade the performance of a single company, you trade the whole sector through a specific index. In turn, they can be valid indicators for regional, national, and global economies.

There is a direct correlation between stock prices and the index price, as the indices act as hosts for the stocks. The higher the volatility of the underlining stocks, the higher the volatility of the index containing those.

You’re trading market movements not just from a single sector, but from a variety of sectors!

Why trade CFDs on indices?

- They provide a general picture over the stock market

- Trade the movement of multiple companies in diverse market sectors

- By trading CFDs on indices, you don’t buy the asset itself, indicating you don’t own the actual index. You only venture on the increase or decline of its price

- They offer perspectives of other markets, industries & companies

What types of CFDs on indices can you trade? Which are the most famous indices?

Global

Global indices relay companies regardless of which stock exchange they are listed on and based.

Regional

Regional indices include companies from specific regions.

National

National indices represent the stock market performance of a given country, reflecting investor sentiment on the health of the economy.

The major indices from the United States are:

S&P 500

The 500 largest companies in the U.S such as Adobe Systems, AES, Twitter, Cisco Systems, eBay, Mastercard, McDonald’s, Nike, Nordstrom, PayPal, Pfizer, Qualcomm, Starbucks and many more. It covers a variety of market sectors such as health care, real estate, utilities, communication, and consumer services.

USA30

Dow Jones Industrial Average is one of the most frequently used indices in the world, with stocks from 30 of the largest and most influential U.S. based companies such as Apple, Chevron, Coca-Cola, Exxon Mobil, Microsoft, Visa, Goldman Sachs, JPMorgan Chase and many more. The DJIA covers sectors like financials, utilities, energy, health care, and so on.

TECH 100

Nasdaq Composite is known for being heavily tech-oriented, covering sectors such as software, biotech but also industrials, insurance, and transportation, among others.

The major indices of Europe:

DAX40

Consisting of the 40 German companies such as E.ON, BMW, Telekom, Allianz, Deutsche Bank. It covers sectors such as clothing, insurance, manufacturing, energy, transport, and many others.

FTSE100

Also called UK100, it represents the UK’s hundred biggest companies by market capitalization such as Unilever, Tesco, Barclays, Vodafone Group, GlaxoSmithKline, Sainsbury’s covering sectors like food, pharmaceuticals, electronics, banks, telecommunications and more.

EUROSTOXX

Covers 12 European countries and represents the 50 largest companies in Europe, such as Bayer, Danone, Volkswagen Group, among others listed in the other European indices.

Indices that cover the Asia-Pacific region:

JAPAN225

Known as Nikkei225, holds companies such as Honda, Yamaha, Nissan, Mitsubishi Motors, Sony, Nikon, and reflects sectors such as chemicals, mining, construction, pharmaceuticals, and more.

HONGKONG50

HongKong50, also called the Hang Seng Index, holds China-based companies from the stock exchanges of Hong Kong, Shanghai, and Shenzhen. Just to name a few big players: Tencent, Bank of China, Yangtze Power, Sinopec, Midea Group and others, covering sectors such as technology, telecommunications, consumer goods, energy, and many more.

ASX200

The number of companies in the Australian index is dynamic, with names such as Suncorp, Domino’s Pizza, Commonwealth Bank, covering health care, financials, utilities, energy, information technology, and many more.

Trading Conditions for CFDs on Forex

Over 15 CFDs on global indices

Leverage up to 1:20

Tight spreads

Zero commissions for deposits*

*Please note that EVPMarket, operated by Key Way Investments Ltd, is not liable for any fees or hidden costs charged by your bank or online payment provider.

Trading Times

Keep in mind that trading hours may vary based on the specifics of every instrument.

For more details, check our dedicated Trading Conditions.