Discover the latest developments as stocks and indices experience slight corrections, the USD strengthens, and key PMI data is released today. Stay ahead with our daily market overview.

The Bull-Run Halted for Stocks and Indices

The stock market took a break from its bullish momentum yesterday. North American and European indices experienced slight corrections. This is despite positive earnings reports released by companies such as United Airlines Holdings Inc. (UAL), Verizon Communications Inc. (VZ), and Johnson & Johnson (JNJ).

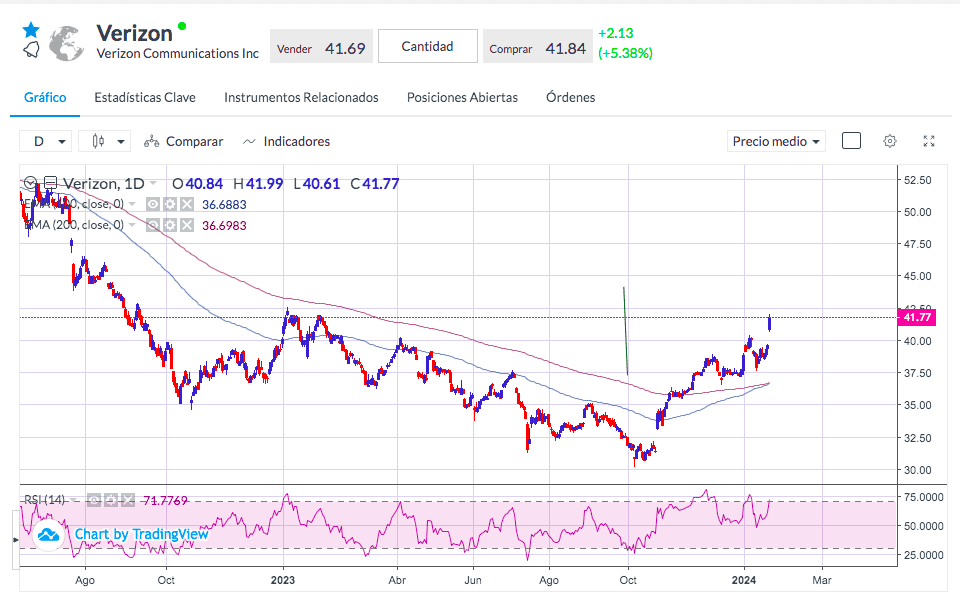

The case of Verizon was the most notable. Verizon revealed an annual earnings range that was above average analyst estimates. They also announced that the telecommunications group was well-positioned for growth in 2024. Verizon’s stock rose as much as 6% following the announcement.

Verizon daily chart, January 23, 2024. Source: EVPMarket WebTrader.

USD Gains from Rate Talks

In the foreign exchange market, the US Dollar is being boosted by a change in market expectations regarding the likelihood of a rate cut in March.

At the beginning of the year, a rate cut in March was considered a certainty, but now the probability has fallen to 42%. For this to happen, a decrease in inflation or employment would be necessary, which makes the North American currency extremely sensitive to upcoming economic data at this time.

BOJ Leaves Rates Unchanged While US PMI Data is Released Today

Today the US Services and Manufacturing PMI data will be released and on Friday the always important inflation data, the PCE report, will be published.

Another positive driver for the US Dollar this year has been the USD/JPY which has been setting continuous highs due to the ultra-accommodative policy of the Bank of Japan. The BOJ met yesterday and left interest rates unchanged again.

The BOJ left its short-term interest rates at negative 0.1% and said it will maintain its yield curve control mechanism by allowing 10-year yields to fluctuate in a range between -1% and 1%, with a target of 0%. The central bank also offered no changes to its asset purchase programs.

However, BOJ Governor Ueda offered hints of an upcoming exit from negative rates, saying potential hikes would still leave monetary policy stimulative. This initially caused a drop in the USD/JPY, but it quickly recovered as the BOJ also stated that it expects Consumer Price Index (CPI) inflation to remain at current levels this year, and that CPI will likely begin to decline in fiscal year 2025, a controlled inflation that does not require an imminent change in monetary policy.

Key Takeaways

- The bullish run for the stock market ended yesterday.

- Indices experienced slight corrections.

- The US Dollar strengthens against the probability of rate changes in March.

- BOJ left rates unchanged yesterday.

- USD/JPY experienced greater movement as it fell sharply then skyrocketed.